Volume Spread Analysis

Printed From: BullCharts Forum

Category: BullCharts

Forum Name: BullScript

Forum Discription: Technical discussion related specifically to the BullScript programming language.

URL: http://www.bullcharts.com.au/forum/forum_posts.asp?TID=504

Printed Date: 24 Dec 2025 at 11:05am

Software Version: Web Wiz Forums 9.69 - http://www.webwizforums.com

Topic: Volume Spread Analysis

Posted By: jalna

Subject: Volume Spread Analysis

Date Posted: 15 Sep 2008 at 7:51pm

| see discussion under" Better Volume" thread |

Replies:

Posted By: cmacdon

Date Posted: 10 Sep 2012 at 11:30am

Posted By: cmacdon

Date Posted: 10 Sep 2012 at 11:49am

|

After doing much reading and a lot of analysis on VSA, the specific indicators tend to be very judgemental. My own coding is 20 A4 pages so it is very unlikly my interpretation of VSA will be the same as anyone elses other than the general thrust of the SOS and SOW principles should be working.Consequently, here is my Bullcharts VSA coding framework showing the variables involved in many of the VSA indicators and two example Sign of weakness 1 and Sign of strength 1 indicators, and source of information i used for my interpretation of those specificators .You can copy and past and add your own additional codes in similar fashion to complete your anaysis of VSA, if you so wish. I also attach a second indicator to colour code the volume bars. [citation =" Wyckoff Supply & Demand CMD This has now

been coded using various sources of Volume Spread Analysis - Undeclared Secrets

and Master of the Markets by Tom Williams, and Master Class 4/4/2010, and

Trading in the Shadow of Smart Money Vol2 (TSSM), and That was the week that

was by Tom Williams. VSA is largely judgemental. The threshold weightings below allow my

interpreatation for the Bullchart coding

CMD"] {In summary there may be a number of indicators for

each of these Principles of weakness 1 End of rising market 2 No Demand at Market Top 3 No Result from effort 4 Upthrusts 5 No Demand on Downtrend 6 Widespread down through previous support 7 Buying Climax 8 Top Reversal Principles of Strength 1 Bottom Reversal 2 Stopping Volume 3 Tests 4 Absorption 5 Bagholding 6 Selling Climax 7 Shakeout 8 No Supply in a rising market} {-------------------------------------------------------------------------------------------------------} { The selection of an appropriate trend calculation

method is most critical as many SOS and SOW indicators depend on whther trend

is up or down.} [target=Price] Vib:=input("Vibration", 4, .001,

100); Z:=Zig(If(Outside() AND Ref(H,-1)>Ref(H,-2),H,If(Outside() AND Ref(L,-1)<Ref(L,-2),L,If((Outside() OR Inside()) AND C>O,H,If((Outside() OR Inside()) AND O>C,L,If(H>Ref(H,-1),H,If(L<Ref(L,-1),L,If(Ref(H,-1)>Ref(H,-2),H,If(Ref(L,-1)<Ref(L,-2),L,C)))))))),Vib,%); Trendup:=Z>ref(z,-1); Trenddown:=Z<=ref(z,-1); {-------------------------------------------------------------------------------------------------------} prd1:=input("Period for Volume MA", 30, 1, 200); prd2:=input("Period for Total Spread

MA", 200, 1, 200); Cut:=input("Narrow Spread Cut

off", 0.5, .05, 0.8); Cut2:=input("UltraWS Cut off", 1.2, .05,

2.0); method

:= inputma("Method",SIMPLE); THExLo:=input("Extreme Low Vol Maximum

Threshold", 0.70, .1, 2); THLo:=input("Maximum for Low Vol

Threshold", 1.0, .1, 2); THNo:=input("Ultra High Minimum Vol

Threshold", 1.3, .1, 2.00); Uf:=input("Upthrust % on previous

High", 1.0005, .05, 2.0); Tf:=input("Test decline

factor", 0.9995, .05, 2.0); Range

:= H - L; ExtremeLowVol:=If(V<=THExLo*ma(V,prd1,s),V,0); LowVol:=If(V>THExLo*

ma(V,prd1,s) and V<=THLo*ma(V,prd1,s), V, 0); HighVol:=If(V>THLo*

ma(V,prd1,s) and V<=THNo*ma(V,prd1,s), V,0) ; UltraHighVol:=If(V>THNo*ma(V,prd1,s),V,0); Upbar:= C>Hist(C,1); Levelbar:=Hist(C,1); {used for TW Easy

Trend rules} Downbar:=

C< Hist (C,1); GapUp:=L>= Hist (H,1); GapDown:=H<= Hist (L,1); NS:=(Range<=Cut*ma(Range,prd2,method)); WS:=(Range>Cut*ma(Range,prd2,method)

) and (Range<Cut2* ma(Range,prd2,method)); UltraWS:=(Range>=Cut2*ma(Range,prd2,method) ); UltraBear:=C<=((Range*0.2)+L); Bear:=C>((Range*0.2)+L) AND C<=((Range*0.50)+L); Bull:=C>((Range*0.50)+L) AND C<=((Range*0.80)+L); UltraBull:=C>((Range*0.80)+L); {SOS 1 Bottom Reversal} SOS1:= If ( (TrendDown OR (Trendup and Hist(c,1)<Hist(c,15))) AND

L<Hist(L,1) AND

Ultrabull AND

(upbar or C=Hist(c,1)) AND

(Hist(Bull,1) OR Hist(Bear,1) OR Hist(Ultrabear,1)) AND

(WS OR UltraWS) {Distinguish from

version 1a} AND

(HighVol OR

Ultrahighvol) AND

(Hist(C,1)<=Hist(C,2) AND Hist(C,1)<=Hist(C,3) AND Hist(C,1)<=Hist(C,4) AND Hist(C,1)<=Hist(C,5)) AND

(Hist(L,1)<=Hist(L,2) AND Hist(L,1)<=Hist(L,3) AND Hist(L,1)<=Hist(L,4) AND Hist(L,1)<=Hist(L,5)),1,0); [name=1 brS; linestyle=marker; marker=long; fontsize=8; tooltip="SOS 1 Bottom Reversal - based on two bars a variety

of versions. Second bar is rapidly marked up to lock in traders that shorted or

to lock you out if you want to buy the market.

People hesitate buying as the shares look expensive relative to

yesterday. THIS VERSION HAS HIGH VOLUME INDICATING SUPPLY IS

STILL PRESENT. We can expect the market to come back down within a few days to

test to see if supply has dried up. (See

SOS1a There is high volume on the second day it indicates supply and we can

expect the market to come back down within a few days to test to see if supply

has dried up). Gavin Holmes Trading in

theShadow of the Smart Money78,79,97.";]; SOS1; {SOW 1S End of Rising Market. Similar to SOW 81b Selling Pressure. Per TW 061110 Markets TOP OUT on NS upbars} SOW1S:= If(H=Highest(H,25) AND

TrendUP AND

(Upbar Or C=Hist(c,1)) AND

UltraHighVol {Vol

=Supply Or See V2 Extreme low Vol No Demand} AND

(NS OR WS) {Added WS as some TG

NS indicators were not getting picked up} {Added Ultrabull as TG indicators sometimes show

close=High} AND

(Ultrabear OR

Bear ),1,0); [name=1 ermSup; marker=short; fontsize=8; tooltip="SOW 1S End

of rising market Supply - Don't see too often Fresh new ground to the left is

not 10 bars but 2 to 3 months or a year per Tom Williams. Gavin Holmes uses 500 bars Psychology: a) Uptrend to the left into fresh new

ground. . b) GapUp in the morning is a

strong sign but some variations have no Gap Up c)SM is selling to satisfy

surges of demand hence putting a cap on higher prices and the NS. d) Buy orders

are being rapidly satisfied. If SM had been buying there would be a wide spread

f)the Close does not make a difference what counts is the NS g)

Ultrahighvol. This is a serious sign of

weakness Gavin conservative approach Follow Up:Wait for

market to mushroom over if you are going to short. Mkt should make lower highs each day. Wait for at least 10 bars in any time frame

to see the result of weakness. TW would jump[ in. In strong down trend there should be increasing vol

on Down bars and decreasing Vol on Up bars.

Wait for a No Demand up bar, an upthrust on either high or low volume in

order to short. The end of a down trend

is often 2 consecutive Up bars followed by a Test or No Supply Down bar. TSSM

5,14,21,22,23,24,30,71 ";]; SOW1S; {-------------------------------------------------------------------------------------------} {This section takes up price colour bars equal to

Volume bars for VSA codes} { Volume Spread Analysis [description="VSA Volume Indicator CMD"]} [target=Price; linestyle=PriceColor] [name=Low Vol; Color=Lime Green] { Low volume} LowVol; [name=High Vol; Color=Dark Violet] { High Volume climax} HighVol; [name=Ultra High Vol; Color=Red] { Ultra High Volume} UltraHighVol; [name=Extreme Low Vol; Color=Orange] {Extremely Low Volume} ExtremeLowVol; {End of Indicator 1 } { Volume Spread Analysis Colour Volume Bars } [description="VSA VOLUME Bars Colours adj weightings "] prd1:=input("Period for MAs", 50, 1,

200); THExLo:=input("Extreme Low Maximum

Threshold", 0.7, .1, 2); THLo:=input("Maximum for Low

Threshold", 1.0, .1, 2); THNo:=input("Extreme High Minimum

Threshold",1.3, .1, 2); Range

:= High - Low; Value1

:= Volume; [linestyle=Bar; width=4] {[name=Normal Vol; Color=Gray] { Normal } Volume;} [name=Extreme Low Vol;Color=Orange] {Extremely Low Volume} If(Value1 <=THExLo*ma(V,prd1,s),V,0); [name=Low Vol;Color=Lime Green] { Low volume} If(Value1 >THExLo* ma(V,prd1,s) and v <=THLo*ma(V,prd1,s), V, 0); [name=High Vol;Color=Dark Violet] { High Volume climax} If(Value1 >THLo* ma(V,prd1,s) and v<=THNo*ma(V,prd1,s), V,0) ; [name=Ultra High Vol;Color=Red] { Ultra High Volume} If(Value1 >THNo*ma(V,prd1,s),V,0); |

Posted By: cmacdon

Date Posted: 17 Sep 2012 at 10:22am

|

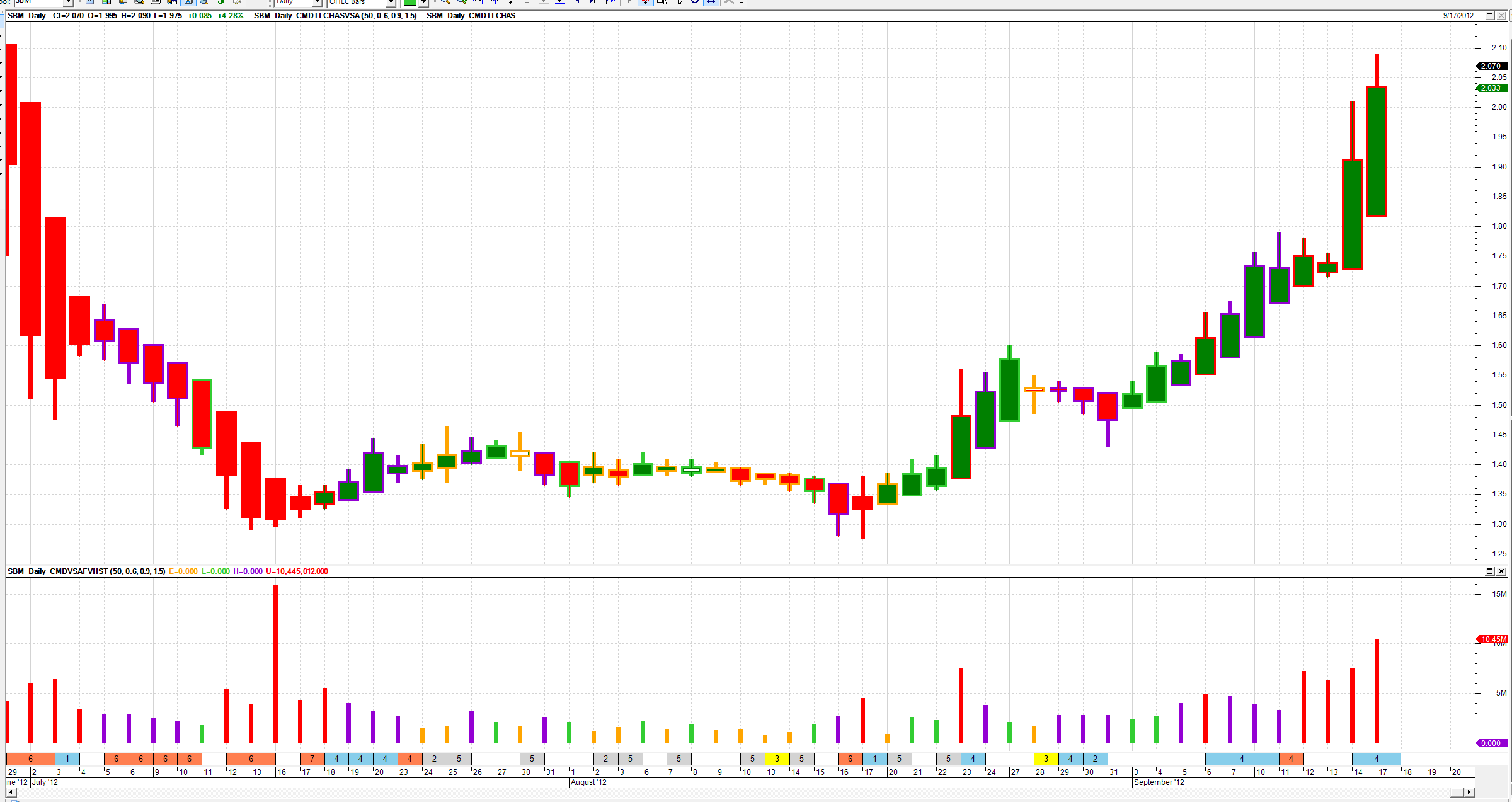

Finally got images working. If any interest, here is BHP at end of GFC run down period and turning point with my VSA indicators, Volume and ribbon  ------------- BC User since June 2007 |

Posted By: cmacdon

Date Posted: 17 Sep 2012 at 1:31pm

Following on from colouring Heikin Ashi bars posts, here is a Heikin Ashi coloured bar version of the above VSA Chart with the HA bars coloured according to the relative volume. ------------- BC User since June 2007 |

Posted By: cmacdon

Date Posted: 17 Sep 2012 at 2:59pm

|

Sorry That was SBM not BHP with coloure HA/VSA Volume bars  ------------- BC User since June 2007 |

Posted By: cmacdon

Date Posted: 17 Sep 2012 at 7:18pm

Here is a neat fusion. Puttimg the VSA coloure Heikin Ashi bars on first then opening the green up and red down HA solid couour inidcator gives a chart where the Heikin Ashi trend bars are shown in the colour of the solid body of the HA bars, and the VSA relative Volume colours appear as the colour of the tails or the body outline; so, provides best of both worlds. ------------- BC User since June 2007 |

Posted By: jazza

Date Posted: 19 Sep 2012 at 1:27am

|

Hi Cmacdon, Wow, a wealth of information contained in your VSA posts. Great info on Wyckoff and Williams and some serious coding there! I have made a template from your formulas supplied. Great top and bottom reversal signals. How easy/difficult would it be to construct a Bullscan of the reversal signals?

|

Posted By: cmacdon

Date Posted: 19 Sep 2012 at 8:35am

|

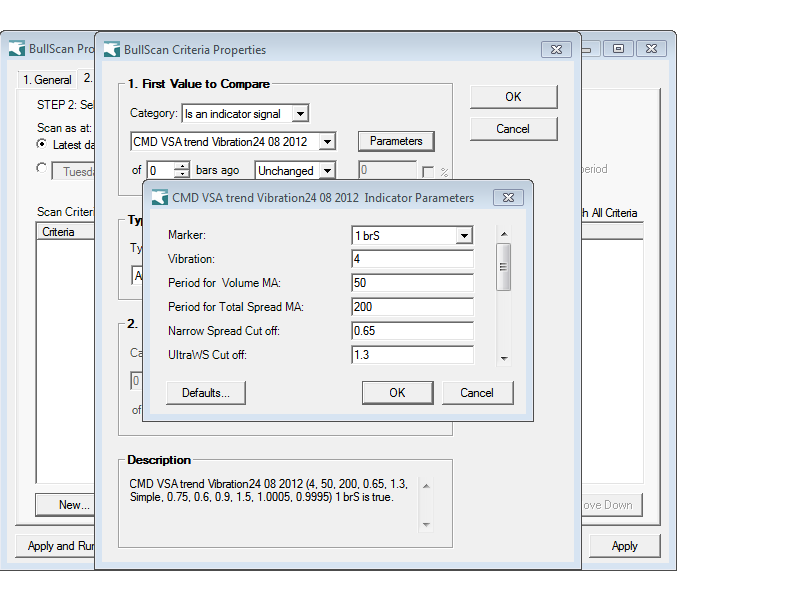

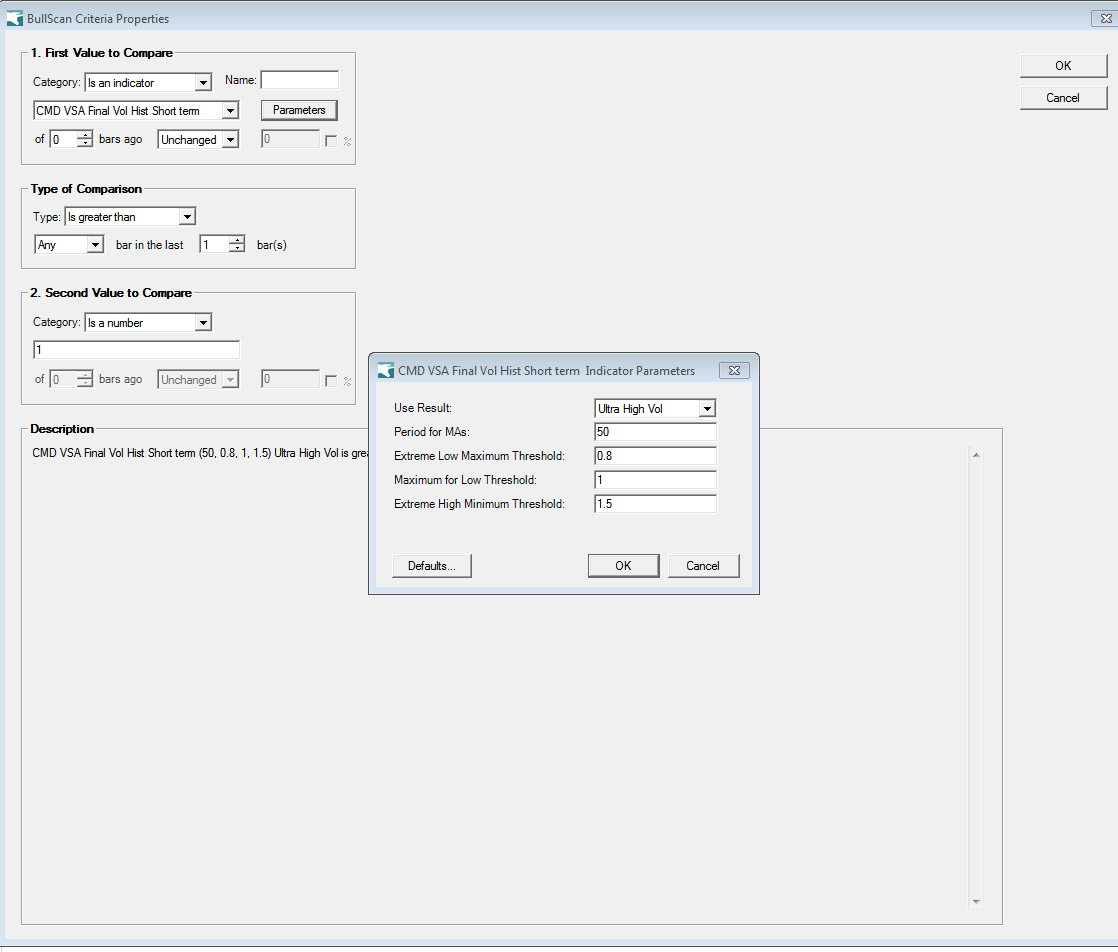

Jazza The scans are easy you then just use select Indicator signal. See two scan pictures below . If I have posted them in the right order, The first is selecting a particular VSA signal from the main indicator - in t5his case Bottom reversal with Supply present. The second uses scan on the VSA coloured volume indicator to find stocks with ultrahighvol .  ------------- BC User since June 2007 |

Posted By: cmacdon

Date Posted: 19 Sep 2012 at 8:37am

Obviously the post boxes doesn't accept two pictures posted together. Here is the Vol scan example. ------------- BC User since June 2007 |

Posted By: cmacdon

Date Posted: 19 Sep 2012 at 9:12am

|

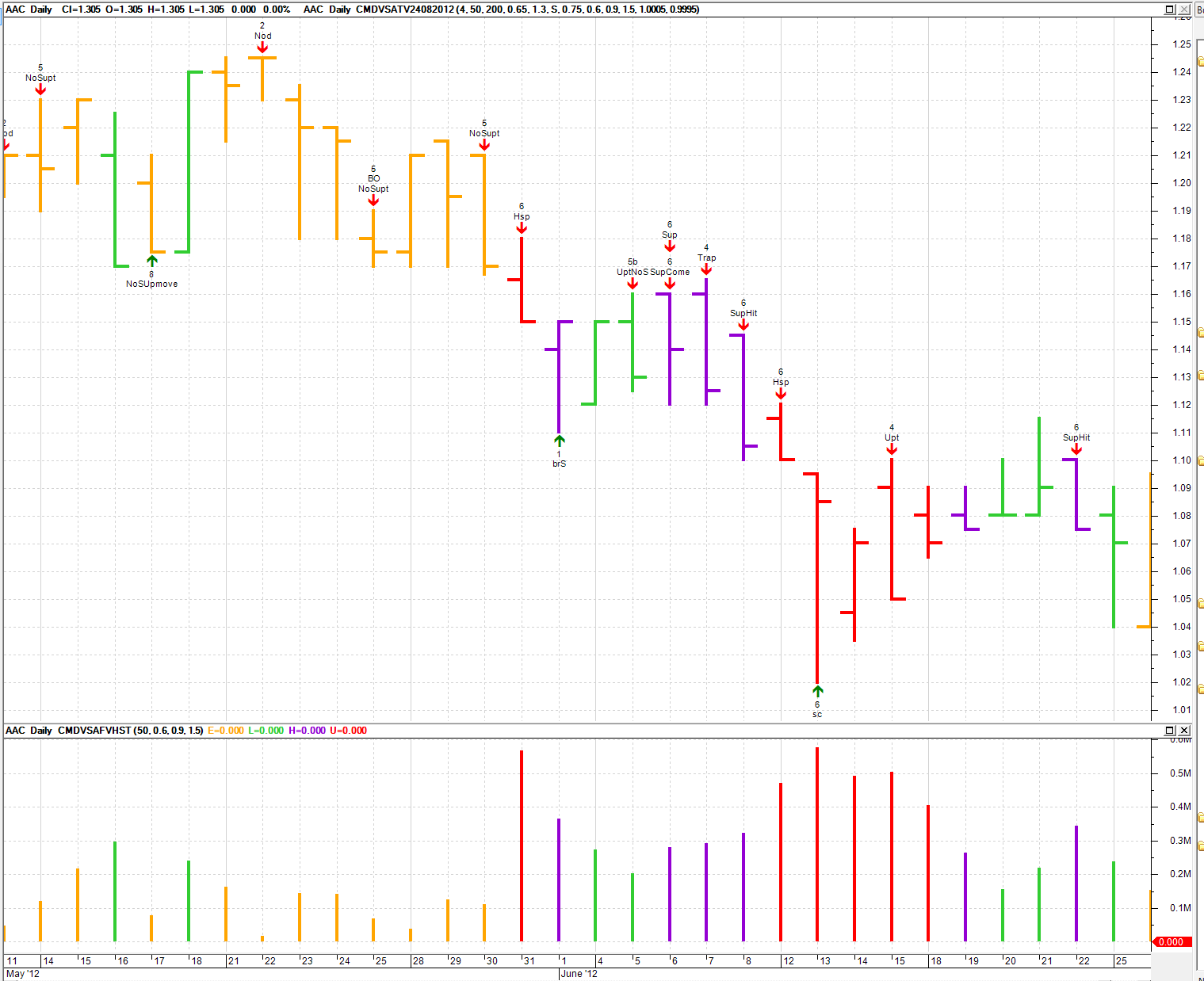

Jazza One word of warning on scans of particular VSA indicators. THe VSA approach is all about reading the charts in context. You do not rely solely on any one indicator but look for them in the context of what other Signs of Weakness and Signs of strength have gone on in the background. See the Chart below where a valid Bottom reversal on high volume is then followed by the Selling Climax on ULtrahigh Volume. IF you traded solely on scanning a Bottom reversal indicator you would probably have lost some money when the Selling Climax hit. The Bottom reversal signal was followed by a 2 bar rally on light volume (lime green bars) before more supply or high volume entered (Dark Violet bars) the market which then led to the Climatic action red bars. So it is all about understanding the context rather than picking a indicator for a winner.  ------------- BC User since June 2007 |

Posted By: Marco

Date Posted: 19 Sep 2012 at 9:26am

|

That's some great work, Cmacdon. I've wanted to explore VSA in more depth for some time, and this will be very useful. Appreciate your hard work in getting this coded up. |

Posted By: jazza

Date Posted: 19 Sep 2012 at 12:59pm

|

Hi Cmacdon, Awesome. Thanks for sharing. Will give them a test drive soon. Cheers Jazza |

Posted By: joea

Date Posted: 22 Sep 2012 at 3:44pm

|

cmacdon I compliment you on your ability to get your head around VSA, and your coding ability. In the case of this stock, you are correct in your comments. If anyone has "Charting the stock market", they will see this explained on page 91. It actually shows how the climax and preliminary support takes place. In the case of this stock there was no prompt rally, after the correction, as such. By this I mean, there was no volume building. However in August the volume came in and the stock made a significant rise. joea |

Posted By: joea

Date Posted: 22 Sep 2012 at 6:32pm

|

In follow up to my last post. http://stockcharts.com/help/doku.php?id=chart_school:market_analysis:wyckoff2 The above link show an explanation for those that are interested. joea |